3 Reasons Why AI Requires an Essential Human Component in RegTech

In the best interest of accurate data, enlisting a team of industry or topic-focused experts will give the AI the direction it needs to better analyze and classify data.

Automatically monitor regulatory updates to map to your internal policies, procesures and controls. Learn More

Automatically monitor regulatory updates to map to your internal policies, procesures and controls. Learn More

1558 Enforcement Actions in the U.S. over past 30 days

FTC enforcements decreased 55% over the past 30 days

SEC issued enforcements: $37,812,859 over the past 30 days

50 Final Rules go into effect in the next 7 days

49 Mortgage Lending docs published in the last 7 days

1670 docs with extracted obligations from the last 7 days

new Proposed and Final Rules were published in the past 7 days

11906 new docs in pro.compliance.ai within the last 7 days

Check out Expert In The Loop Forum OnDemand!

Considering RCM Solutions? Here’s an RFP to get started.

May 23, 2018

In the best interest of accurate data, enlisting a team of industry or topic-focused experts will give the AI the direction it needs to better analyze and classify data.

Machine learning explores algorithms that can learn from and make predictions on data. There are two types of machine learning: unsupervised and supervised learning. Unsupervised learning is when the task is to group a collection of unlabeled patterns into meaningful categories. This type of learning is typically associated with data mining and big data analytics. There are no labels assigned to the algorithm, leaving the machine to discover its own structure. This is useful in identifying hidden patterns and anomalies.

Supervised learning is when a collection of labeled patterns is provided, and the learning process is measured by the quality of labeling a newly encountered problem. With active learning, a computer can only obtain training levels for a limited set of instances but can optimize its choice of labels. It can be presented to the user for labeling.

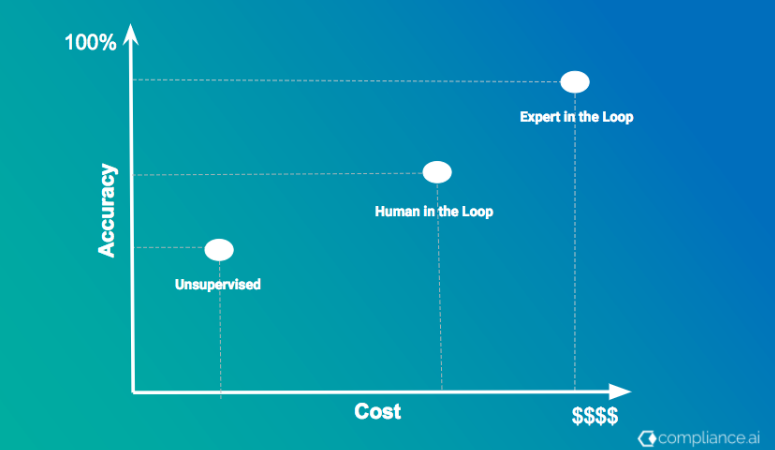

On average, most AI algorithms are only about 80 percent accurate, which doesn’t live up to the business standards of accuracy. That leaves 20 percent flawed, which needs human input to bridge that gap. There is an inherent design flaw to any AI which does not use some human component in development. It is a general understanding that the most successful AI models use the 80:20 rule, where 80 percent is AI generated, and 20 percent is human input.

This human component is commonly referred to as “Human-in-the-Loop,” and is considered a best practice in the successful development of AI. The way it works is that machine learning makes the first attempt to process the data and it assigns a confidence score on how sure the algorithm is at making that judgment. If the confidence value is low, then it is flagged for one/many humans to help with the decision. Once humans make the decision, their judgments are fed back into the machine learning algorithm to make it smarter. Through active learning, the intelligence of the AI is strengthened, but the quality of the training data is taken in from human contributors. Some data analysis is specific and complex, such as the case with Financial Regulation. There are three major reasons why the human component is essential to AI integration in RegTech.

AI in RegTech requires in-depth knowledge and understanding of the regulatory framework and how to read and interpret the text. In these types of fields, expertise is far more critical than the tool. However, if a tool could incorporate subject matter experts into the machine learning model, then the tool becomes exponentially more viable.

It makes use of expert contributors to train the machine while also flagging the machine’s errors. For example, a well-trained machine in the RegTech industry could eliminate countless hours a compliance officer takes in researching, reading, and interpreting regulations, by automatically classifying documents into topic-specific categories or extracting only the aspects of the document that have changed from the previous version.

The Expert-in-the-Loop model differs from Human-in-the-Loop in one major way: Human-in-the-Loop doesn’t differentiate between the aptitude level of the various participants to answer the particular question correctly. Human-in-the-Loop takes advantage of the “Law of Averages,” which states that if many people participate, the average response will yield the correct result. So the response from a high school student and a Ph.D. student would be weighed the same.

On the other hand, Expert-in-the-Loop, specifically looks at the experience level of the participant to determine how their result will be weighed. With Expert-in-the-Loop, a human is essentially supervising another human’s qualifications. While the cost is higher than both the Unsupervised and the Human-in-the-Loop models, the results of Expert-in-the-Loop models are proportionally more accurate, making them suitable for highly specialized and industry-specific topics.

Companies leveraging AI realized that the need for expert input for document classification. In the best interest of accurate data, enlisting a team of industry or topic-focused experts will give the AI the direction it needs to better analyze and classify regulatory data. A high level of accuracy is required for use in security, banking, compliance and regulation, industries. With expert engagement, AI-based solutions should be able to create interactive graphs and trends. These provide marketing, IT and operational teams with a bird’s eye view of activity at whatever level they need.

The truth is, AI is reliant on its human counterpart in order to consistently improve its accuracy. Humans are using AI to increase efficiency and streamline analysis. The future holds endless possibilities for this evolving technology, and as long as it is guided by a human hand, it serves as a bridge to close the gap between information and the time it takes to compile results.

With more than 25 years of experience in hi-tech, Kayvan leads operations, strategy, sales, and marketing for Compliance.ai. Most recently, Kayvan led the identity strategy at RSA, and represented EMC on various industry alliances such as the FIDO board. He is Co-Founder and CEO of PassBan (acquired by RSA), a company focused on mobile identity assurance. Kayvan also led strategy at LiteScape (as CTO and later as CEO), creating security and mobile identity solutions for VOIP based networks. He was Co-Founder and CTO at BeNotified, a cloud mobile communication service provider.